“I Would Prefer Not To” — The Origins of the White Collar Worker

StandardNikil Saval | Cubed: A Secret History of the Workplace | Doubleday | April 2014 | 31 minutes (8,529 words)

Below is an excerpt from the book Cubed, by Nikil Saval, as recommended by Longreads contributor Dana Snitzky.

* * *

I have known the inexorable sadness of pencils…

—Theodore Roethke, “Dolor”

The torn coat sleeve to the table. The steel pen to the ink. Write! Write! Be it truth or fable. Words! Words! Clerks never think.

—Benjamin Browne Foster, Down East Diary (1849)

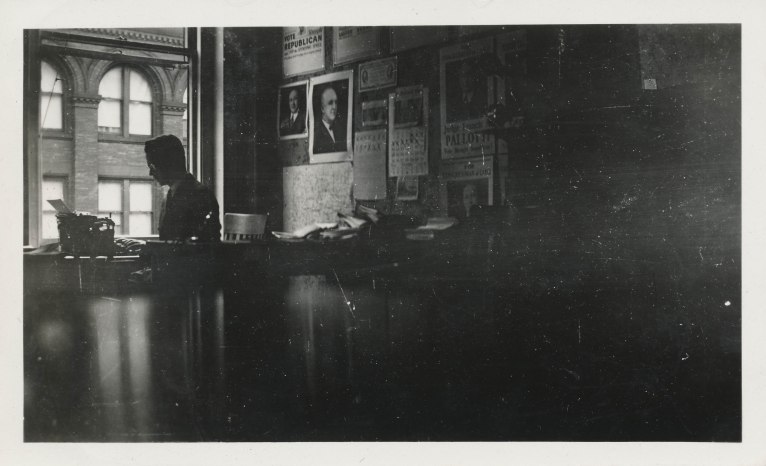

They labored in poorly lit, smoky single rooms, attached to merchants and lawyers, to insurance concerns and banks. They had sharp penmanship and bad eyes, extravagant clothes but shrunken, unused bodies, backs cramped from poor posture, fingers callused by constant writing. When they were not thin, angular, and sallow, they were ruddy and soft; their paunches sagged onto their thighs.

View original post 8,569 more words

Home lenders report increased demand

StandardWith average long-term U.S. mortgage rates remaining close to historically low levels and the spring home-buying season underway, local mortgage brokers are reporting a surge of refinance and purchase applications.

Chris Salese, branch manager at Del Sur Mortgage, said the number of mortgage applications received by his company has doubled over last year.

“We didn’t anticipate rates to stay where they are at for this long,” he said. “It triggered a huge wave” of applications.

Mortgage giant Freddie Mac said Thursday the national average for a 30-year fixed-rate mortgage ticked up to 3.70 percent from 3.69 percent the previous week.

The average rate for a 15-year mortgage, popular with homeowners who refinance, edged up to 2.98 percent from 2.97 percent.

A year ago, the average 30-year mortgage rate was 4.41 percent and the 15-year mortgage rate was 3.47 percent. Mortgage rates have remained low even though the Federal Reserve in October ended its monthly bond purchases, designed to hold down long-term rates. The Fed signaled recently that it’s still not ready to start raising short-term rates after keeping them near zero for more than six years.

According to local loan officers, in addition to those low rates, other factors have contributed to the increased demand.

Although appreciation has slowed somewhat in recent months, home values in Napa County have risen in past years, said Dale DiGennaro of Custom Lending Group, Inc.

“Some people couldn’t refinance previously because they were underwater,” and the value of their home was at the amount of the mortgage or lower, he said. “Once they get the equity, they can refinance.”

That can also lead to more home sales, he added, which leads to an increase in mortgage applications.

He’s seeing a 70 percent increase in mortgage applications at his business, said DiGennaro.

Another factor that’s impacting the increase is that the Federal Housing Administration (FHA) mortgage insurance premium dropped by a half percent. Today, some of those with FHA loans are refinancing to get a slightly better interest rate and a reduction in their mortgage insurance premium, he said.

Laura Miller, a loan officer with Benchmark Mortgage, said she’s seen the number of mortgage applications double. “People were on the fence, uncertain as to whether or not prices were going to start improving,” she said. With home prices increasing, “now they’re off the fence and want to purchase before it gets too expensive.”

And with mortgage rates remaining lower, “they can afford a little bit more of a home.”

Lower rates, decreased local unemployment and an improving economy “couldn’t be a better recipe for helping homeowners save money, and stay in their homes for the long run,” Miller said.

Salese said another factor is increased chatter about when the Fed will raise rates — and if they do, by how much. “Despite the fact that the Fed rate decisions don’t necessarily have a direct impact on rates for 30-year fixed mortgages, nonetheless this has naturally caused a sense of urgency for homeowners to refinance.”

Also, Napa is “shaking off the earthquake blues,” and people want to “stay put, hunker down and improve their homes.”

Salese also asked that refinance customers have patience with their lenders. The flood of refinance applications means a process that normally takes 30 to 45 days can now take as long as 60 to 75 days.

More Americans signed contracts to buy homes in February, the National Association of Realtors reported, providing evidence that the buying season could open strong after sluggish sales for much of the winter.

clipped: http://napavalleyregister.com/news/local/home-lenders-report-increased-demand/article_b3dd4672-886e-5a2e-813c-9a43437640ae.html

And so Ive just read that FHA refinance volume is largest that is has been in more than two years. In todays refinance boom we, must utilize all our resources. http://brokermatch.com/

Its time to capitalize on 2015’s housing market opportunities

According to a recent Freddie Mac Economic & Housing Market Outlook report, both the U.S. economy and the housing market are poised for a “robust start” to 2015, with a number of positive economic factors at work.

Should the use of selected microorganisms for alcoholic or malolactic fermentation be considered as additives in wines?

Standard Winemaking is a fascinating creative process whose interpretation includes both craft and a science. While the majority of winemakers aim for a balance between both philosophies, divided opinions on what extent wine production should be manipulated and controlled to produce the best wines spark highly controversial discussions. Current conventional understanding of microorganisms used in the process of alcoholic and malolactic fermentation is to classify them as processing aids, regardless whether they are indigenous or selected. Nevertheless, the natural wine movement insists that anything added (e.g. lab-bred yeasts, enzymes or bacteria) to wine should be listed as an additive and therefore be declared on the label so that consumers can make an informed choice. However, what happens when wild yeasts are selected from a specific ecosystem for their individuality and then are reproduced for the following vintages in order to achieve reliability? And would consumers really benefit from this transparency reflected…

Winemaking is a fascinating creative process whose interpretation includes both craft and a science. While the majority of winemakers aim for a balance between both philosophies, divided opinions on what extent wine production should be manipulated and controlled to produce the best wines spark highly controversial discussions. Current conventional understanding of microorganisms used in the process of alcoholic and malolactic fermentation is to classify them as processing aids, regardless whether they are indigenous or selected. Nevertheless, the natural wine movement insists that anything added (e.g. lab-bred yeasts, enzymes or bacteria) to wine should be listed as an additive and therefore be declared on the label so that consumers can make an informed choice. However, what happens when wild yeasts are selected from a specific ecosystem for their individuality and then are reproduced for the following vintages in order to achieve reliability? And would consumers really benefit from this transparency reflected…

View original post 772 more words

Better to go to a locksmith for new car keys?

StandardForget trying to replace the buttons, or the cases. The buttons on the original are “welded” to the case on the inside. The replacements off auction web sites will just float around inside the case. Useless. As well as you’ll be challenged to get the original secrets apart without destroying the situation (it’s ultrasonically welded together)

You can buy alternative cases off ebay (non-genuine of course), nonetheless they may work perfectly. Besides, the internal battery will likely be shot anyway (or near to)

I got my first replacement key (including blade) from Mr Minit, I think it was about $150, and I’m almost certain that they used genuine Holden parts.

We got two further genuine uncoded electronic ‘heads’ off Gumtree, for about $80 (the guy worked for a Holden spare elements… Specialists no questions… ), then had them coded for ~$70 the pair at the local key cutting devote North Rocks. I re-used the original blades. Unless the blades of your existing secrets are worn (doubtful! ) you really only need the heads, I reckon. Dunno what Holden cost, but Holmart has genuine ones for $68 each: http://locksmithnorthbrisbane.com/

Word of alert: Do not get to the point where you have no working keys, as I actually believe the locksmiths use the existing step to clone the new one. I would feel that if they can’t do this, you would need to go to Holden and pay whatever there is a saying…

On a related note: if your key is getting sticky/reluctant to turn in the key barrel, do yourself a favour and obtain a new barrel before it jams up completely. Just about $30 and an hour or so to replace (I did mine myself but it is somewhat fiddly… )

TRY THESE 10 “DESPERATE MOM CURES” FOR YOUR CHILD’S FEVER!

StandardPocari sweat does help!

Stonehenge – Promote Yourself

StandardTwo-Headed Dolphin Is Super Rare

StandardA dead two-headed dolphin that washed ashore in Turkey earlier this week has made waves across the Internet.

Quiet Thursdays – Moon Gazing

StandardTrue or False?

StandardFat is unhealthy for you, and should be avoided at all costs.